Creating and sticking to a budget can seem daunting. Still, with the right strategies and mindset, saving more every month is possible. In this post, we’ll explore practical and detailed budget tips to help you better manage your finances and achieve your savings goals. These budget tips are designed to be comprehensive and actionable, providing you with a clear path to financial stability.

1. Track Your Spending

The first step to effective budgeting is understanding where your money goes. By tracking all your expenses for at least a month, you gain a clear picture of your spending habits, empowering you to make informed financial decisions.

How to Track Your Spending

- Use Apps: Applications like Mint, YNAB (You Need A Budget), and PocketGuard can automatically categorize expenses and provide insights.

- Manual Tracking: Alternatively, keep a spending diary and note every purchase. This method can be more labour-intensive but offers greater awareness of your spending patterns.

2. Set Clear Financial Goals

Having clear, specific goals can keep you motivated and focused. Whether saving for a vacation, a down payment on a house, or building an emergency fund, achieving these targets will give you a sense of accomplishment and inspire you to stick to your budget.

How to Set Financial Goals

- Short-term Goals: These could range from saving for a new gadget to paying off a credit card debt within six months.

- Long-term Goals: Consider retirement savings, buying a home, or establishing a college fund for your children.

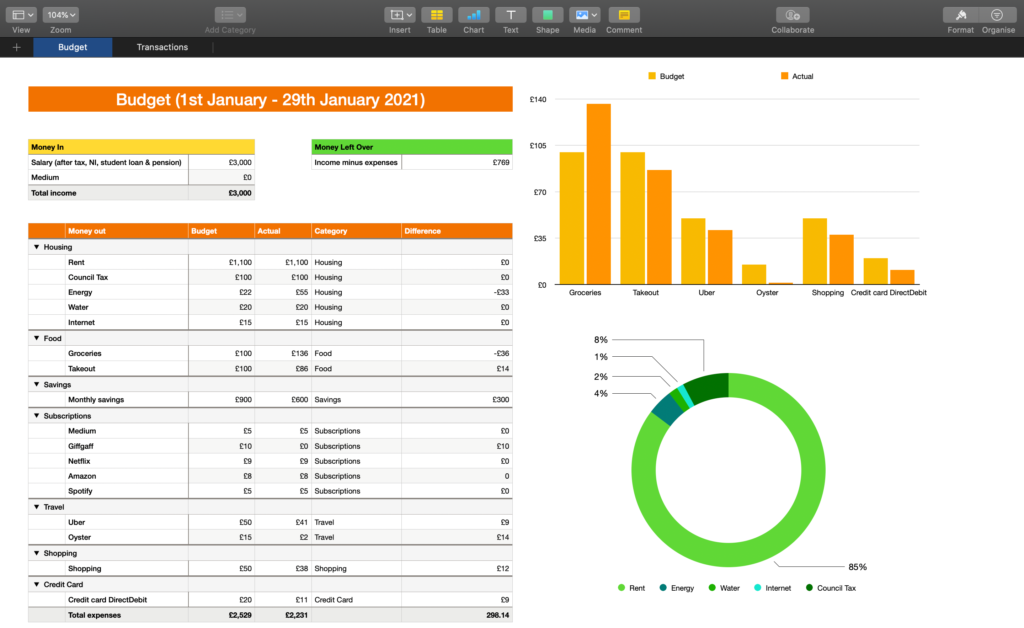

3. Create a Realistic Budget

Your budget should reflect your actual income and necessary expenses. Be realistic about your needs and lifestyle to ensure your budget is sustainable.

Steps to Create a Realistic Budget

- List All Income: Include salary, freelance income, rental income, etc.

- List All Expenses: Fixed expenses like rent and variable expenses like groceries.

- Subtract Expenses from Income: This gives you a clear view of your disposable income.

4. Prioritise saving

Treat your savings as a non-negotiable expense. Paying yourself first ensures that saving becomes a habit rather than an afterthought.

Ways to Prioritise Saving

- Automatic Transfers: Set up automatic transfers to your savings account.

- Savings Challenges: Participate in savings challenges, like the 52-week challenge, to make saving fun and competitive.

5. Reduce Unnecessary Expenses

Identifying and cutting unnecessary expenses is crucial for effective budgeting. This might involve some lifestyle changes but can significantly boost your savings.

How to Reduce Unnecessary Expenses

- Review Subscriptions: Cancel unused subscriptions or downgrade to cheaper plans.

- Cook at Home: Eating out frequently can drain your finances; cooking at home is healthier and cheaper.

- Energy Efficiency: Implement energy-saving measures at home to reduce utility bills.

6. Use Cash for Variable Expenses

Using cash for variable expenses like groceries and entertainment can help you stick to your budget by preventing overspending.

Benefits of Using Cash

- Visual Spending: Seeing your cash deplete makes you more aware of your spending.

- However, using cash can also be risky as it is more susceptible to loss or theft. Always ensure the safety of your cash and consider using other payment methods for larger purchases.

7. Plan Your Meals

Meal planning can drastically reduce grocery bills and food waste. You can buy in bulk, use leftovers efficiently, and avoid last-minute takeout orders by planning your meals.

Meal planning not only saves you time and money but also helps you make healthier food choices and reduce food waste. It’s a win-win for your budget and your health.

How to Plan Your Meals

- Weekly Planning: Spend some time planning your meals and creating a shopping list each week.

- Bulk Cooking: Prepare meals in bulk and freeze portions for later use.

8. Take Advantage of Discounts and Coupons

Always look for discounts, sales, and coupons before making purchases. This small effort can lead to significant savings over time.

Finding Discounts and Coupons

- Online Resources: Websites and apps like Honey, Rakuten, and RetailMeNot offer coupons and cashback.

- Store Loyalty Programs: Sign up for store loyalty programs to get exclusive discounts.

9. Review and Adjust Your Budget Regularly

Your financial situation and goals may change, so reviewing and adjusting your budget is essential. This ensures that your budget remains effective and aligned with your current needs.

How to Review and Adjust Your Budget

- Monthly Reviews: At the end of each month, compare your budgeted amounts with actual spending.

- Adjust Categories: If specific categories consistently exceed the budget, adjust them to more realistic amounts.

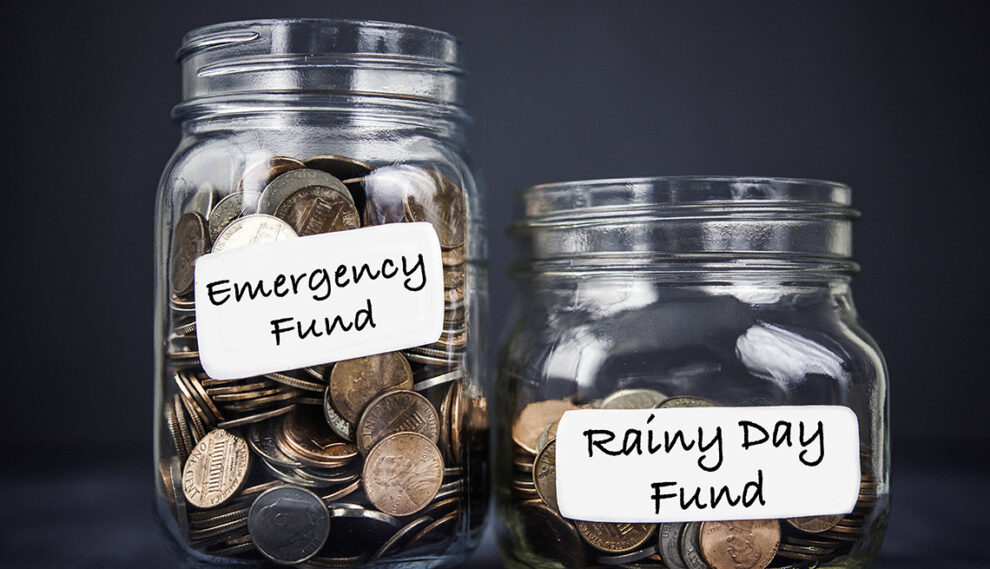

10. Build an Emergency Fund

An emergency fund is a crucial part of any financial plan. It provides a safety net for unexpected expenses, such as medical bills or car repairs, and gives you a sense of security and peace of mind, knowing you’re prepared for the unexpected.

Steps to Build an Emergency Fund

- Set a Goal: Aim to save at least three to six months’ expenses.

- Start Small: If this seems daunting, start with a smaller goal, like $500, and gradually build up.

By following these budget tips, you can take control of your finances and increase your monthly savings. Implementing these strategies requires discipline and commitment, but the financial freedom and peace of mind you gain will be well worth the effort. Remember to tailor these tips to fit your personal situation, and be bold and adjust as needed. Happy saving!

Stay Updated and Save More! Don’t miss out on our latest budget tips and exclusive offers. Sign up for our newsletter today and join our community of savvy savers. Start your journey towards a more secure financial future now!

Use practical advice and expert insights to help you achieve your financial goals. Subscribe now and start your journey to better budgeting and saving!

Add Comment