Millions of UK residents might be overpaying their council tax bills simply because they need to understand how to calculate their council tax. Council tax is more than just another bill – it’s a payment that could vary greatly depending on factors such as your property’s value, local authority, and specific circumstances.

However, many homeowners and renters overlook the opportunities to save money or correct errors that might cost them hundreds of pounds yearly. It’s time to take control of your council tax and ensure you’re paying what you should!

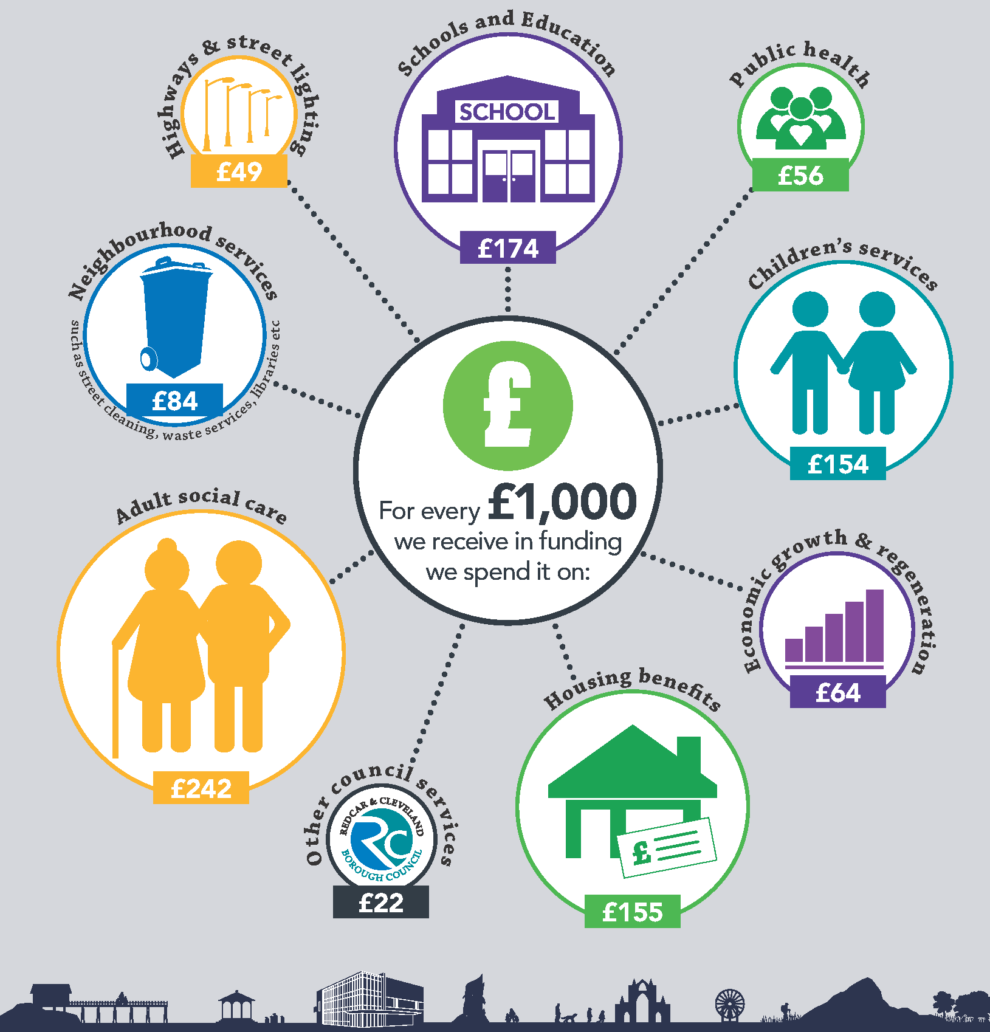

Local authorities collect council tax to fund a range of public services, such as schools, waste collection, social care, and emergency services. While it is critical in supporting your community, knowing how to calculate this tax and whether you’re paying the correct amount is equally essential. Understanding how to calculate council tax helps ensure you’re spending enough and allows you to spot potential savings through discounts, reductions, or exemptions available to you.

In this post, we will explain how to calculate council tax, what influences the amount you pay, and how to find and understand your council tax band. We will offer step-by-step guidance so that, by the end of this post, you can confidently take control of your council tax payments and make the most of any opportunities to save.

Council Tax Explained: What’s It All About?

Council tax is a local tax system that every household in the UK pays to help fund a range of services your local council provides.

It’s similar to property tax systems in other countries, but it bases your tax on your property’s valuation and the number of occupants. Your financial contribution ensures the community’s essential services run smoothly. Council tax helps pay for waste collection, street maintenance, police and fire services, schools, libraries, and social care.

- How Is It Collected? Your local authority is responsible for issuing council tax bills for the financial year ahead, typically each March. Most households pay their council tax in 10 instalments annually, although you can pay in a single lump sum or spread payments across 12 months.

- Why Was It Introduced? The current council tax system replaced the “community charge” or “poll tax” in 1993 after a public backlash against the old system. Unlike income-based taxation, council tax relies on property value, ensuring homeowners and renters pay according to the relative worth of their homes.

- How Is It Calculated? Council tax is calculated based on the value of your property and the local rate set by your council. The “band” each property falls into (more on this later), and any applicable discounts, exemptions, or reductions influence the amount each property pays. Each band is associated with a different payment level, so properties in higher bands pay more council tax.

What Does Council Tax Pay For?

Understanding what your council tax pays for is crucial, as it helps justify the expense and provides a sense of contribution to your local community. Here’s a breakdown of the primary area’s council tax helps fund:

- Waste Management & Recycling – Much of your council tax goes towards waste collection, recycling services, and landfill management. The cost covers regular bin collections for general, recycling, and garden waste. Additionally, councils use these funds to ensure waste is processed and disposed of in an environmentally friendly manner, complying with regulations around waste management.

- Education Services – Council tax helps support local schools, special educational needs programs, and adult education services. While most of the school funding comes from central government grants, council tax is supplementary in maintaining facilities, providing equipment, and improving local educational services. If there are local education initiatives or after-school programs, some of their funding may also come from council tax.

- Social Services & Care – From home care for older people to community support for vulnerable populations, council tax helps fund social care services. The council supports mental health, provides childcare, cares for the elderly, and initiates safeguarding for children and vulnerable adults. With council tax, many of these vital support systems would avoid funding gaps, impacting those who rely on these services the most.

- Public Safety & Community Services – Council tax supports the operation of your local fire and police services, contributing to public safety and security. Moreover, council tax funds community initiatives, public recreational centres, libraries, and cultural institutions, allowing for public safety and community welfare maintenance.

- Environmental Services & Street Maintenance – Council tax contributes to maintaining the appearance and functionality of your local area. It supports street lighting, road repairs, upkeep of public parks and spaces, and environmental conservation. Consider how often you walk along a well-lit, clean street or visit a well-maintained park—council tax plays a role in ensuring these amenities are available.

- Housing & Planning Services – Local authorities use council tax to manage public housing, assist people experiencing homelessness, provide housing advice, and oversee urban planning. The council allocates funds to ensure safe, appropriate housing for residents and manages development plans for future housing or public spaces.

Ultimately, council tax is used to support the essential day-to-day operations of your local area, providing a better quality of life and community well-being.

How Your Property’s Council Tax Band is Determined

One of the main components in determining how much council tax you pay is the “band” your property falls into. Bands are categories that reflect the value of a property as of a specific date—April 1, 1991, for properties in England and Scotland, and April 1, 2003, for properties in Wales. The valuation was initially set by the Valuation Office Agency (VOA), and properties are categorised from Band A (lowest value) to Band H (highest value), with Wales including an additional Band I.

The tax rates associated with each band vary by local authority, so while a property in Band D might pay one rate in one part of the UK, it could pay a different rate elsewhere. This is because local councils set the amount they need to fund services distributed across the bands.

Factors Influencing Your Council Tax Band

The initial valuation of a property is based on several factors:

- Location: A property’s location significantly impacts its band, with homes in affluent or central areas generally falling into higher bands.

- Size & Type: Larger properties or detached homes often fall into higher bands, while smaller flats or terraced homes may be placed in lower bands.

- Property Condition & Features: Elements like having a garden, a garage, or a view can all play into the valuation of your home. If your property has been significantly improved (e.g., through an extension or conversion), this may also trigger a reassessment of its band.

It’s important to note that properties are rarely revalued, but the VOA can review the band if significant changes are made to a home.

How to Check Your Council Tax Band

If you’re unsure of your current council tax band or believe your property is incorrectly valued, you can check it online using the official government websites:

Your council tax statement will also show your property’s band, typically near the top of the statement, along with your property details.

If you need more detailed guidance on where to find your council tax band, how to reduce your council tax bill, or how to appeal your council tax banding, check out our detailed guide: How to Check Your UK Council Tax Band and Reduce Your Bill.

How Your Council Tax is Calculated

Council tax is calculated based on three primary components: your property’s valuation band, the local council’s tax rate, and any additional precepts for local services. Understanding how these elements form your bill can help you identify whether you’re paying the correct amount and if any savings are available.

Your Property’s Valuation Band

Every residential property in England, Scotland, and Wales is placed into a valuation band based on its estimated market value at a certain point in time:

- England and Scotland: The property value as of April 1, 1991.

- Wales: The property value as of April 1, 2003.

The valuation bands range from A (lowest value) to H (highest value) in England and Scotland and from A to I in Wales. Each band represents a range of property values, and the band your property is placed into determines the proportion of the base council tax rate you will pay.

For example, in England, the bands typically are:

- Band A: Up to £40,000

- Band B: £40,001 to £52,000

- Band C: £52,001 to £68,000

- Band D: £68,001 to £88,000

- Band E: £88,001 to £120,000

- Band F: £120,001 to £160,000

- Band G: £160,001 to £320,000

- Band H: Over £320,000

These bands are then linked to a base council tax rate, usually represented by Band D, which serves as a benchmark. Other bands pay a proportion of this Band D rate. For example, Band A properties might pay 6/9 of the Band D rate, whereas Band H could pay double.

Local Council’s Tax Rate (Precept)

Your local authority or council is responsible for setting the tax rate for each band within their area, which can vary annually. This is known as the “precept.” It is essentially a percentage or multiplier applied to the property bands to determine the council tax rates for the year.

The local council’s tax rate is set based on their budget needs for the year, funding various local services like:

- Education and Social Care: Schools, support for older people, and social services.

- Waste Collection and Management: Waste and recycling collections, disposal, and environmental upkeep.

- Public Safety: Police, fire, and rescue services.

Local Variation: Council tax rates vary by region. Urban areas with a higher population might have lower individual tax rates due to a more extensive tax base. In contrast, rural areas have higher rates due to lower population density.

Additional Precepts for Local Services

In addition to the local authority’s base council tax rate, there may be extra precepts that fund other specific services, such as:

- Police and Crime Commissioners: To fund local policing and public safety.

- Fire and Rescue Services: Contributions toward fire safety services and fire brigades.

- Transport Authorities or Parish Councils: In some areas, there might be additional charges for local transport services, infrastructure, or parish council services.

These additional charges are added to the base rate to arrive at the final council tax bill.

Putting It All Together with An Example Council Tax Calculation

Understanding how your council tax is calculated can demystify your bill and help you identify potential savings. Let’s break down a sample calculation for a Band D property and explore the factors affecting your pay.

Example Council Tax Calculation

- Base Rate Set by Local Council

Your local council sets a base rate for properties in each band. For this example, let’s assume the base rate for a Band D property is £1,200 per year.

- Additional Precepts Added

Additional charges, known as precepts, fund specific local services and are added to the base rate:

- Police Precept: £150

- Fire Service Precept: £50

- Other Local Services (e.g., transport, community projects): £100

- Total Annual Council Tax

Adding these together:

- £1,200 (Base Rate)

- + £150 (Police Precept)

- + £50 (Fire Service Precept)

- + £100 (Other Local Services)

- = £1,500 Total Annual Council Tax

This total amount is typically divided over 10 or 12 monthly instalments, forming your regular council tax payments.

Adjusting for Different Property Bands

Since Band D serves as the standard benchmark, properties in other bands pay a proportion of the Band D rate:

- Band A: Pays 6/9 of the Band D rate

- Band B: Pays 7/9 of the Band D rate

- Band C: Pays 8/9 of the Band D rate

- Band E: Pays 11/9 of the Band D rate

- Band F: Pays 13/9 of the Band D rate

- Band G: Pays 15/9 of the Band D rate

- Band H: Pays 18/9 (or double) the Band D rate

Example Calculations:

- Band A Property:

6/9 of £1,500 = £1,000 annual council tax

- Band B Property:

7/9 of £1,500 = approximately £1,166.67 annual council tax

- Band H Property:

18/9 of £1,500 = £3,000 annual council tax

Factors That Influence Your Council Tax Bill

Several factors can affect your council tax band and the amount you pay:

- Property Changes

- Revaluations or Alterations: Significant modifications to your property, such as extensions, conversions, or adding new structures, can lead to a revaluation. If your property’s value increases due to these changes, it may move into a higher band, resulting in a higher council tax bill.

- Local Authority Budget Changes

- Annual Budget Adjustments: Each year, your local council reviews its budget to meet the funding needs of essential services. Changes in the council’s budget can impact the tax rate for each band, so your council tax bill could change annually even if your property’s band remains the same.

- Eligibility for Discounts or Exemptions

- Single-Person Discount: If you live alone, you’re entitled to a 25% reduction.

- Students: Full-time students are generally exempt from paying council tax.

- Disability Reduction Scheme: If you or someone in your household is disabled and requires additional space or home adaptations, you may qualify for a reduced bill.

- Low-Income Households: Those on a low income or receiving certain benefits might be eligible for Council Tax Reduction schemes.

- Empty or Unfurnished Properties: Some councils offer discounts or exemptions for unoccupied properties.

By combining these insights, you gain a comprehensive understanding of how your council tax is calculated and what factors might influence your bill:

- Calculation Breakdown: Knowing the base rate and additional precepts helps you see exactly where your money goes.

- Band Adjustments: Understanding how different bands affect the amount you pay allows you to anticipate your annual payments.

- Influencing Factors: Awareness of property changes, budget adjustments, and potential discounts can help you manage your council tax more effectively.

Understanding your council tax can lead to significant savings and ensure you only pay what you owe. If you believe there’s an error or you’re spending more than necessary, consider checking your property’s band or exploring available discounts to ensure you’re contributing a fair amount.

Reductions and Discounts To Your Council Tax Rates

While your council tax bill is primarily determined by your property’s valuation band and the rates set by your local authority, you may be eligible for various reductions and discounts that can significantly lower the amount you pay. Understanding how these discounts interact with your council tax band and affect the overall calculation is essential for effective financial management.

Common Council Tax Discounts and Exemptions

Council tax can be a significant expense, but you may be eligible for various discounts and exemptions to lower your bill regardless of your property’s council tax band. Here are some standard options:

- Single-Person Discount (25% Off): If you’re the only adult living on your property, you’re entitled to a 25% reduction on your council tax bill. This acknowledges that single occupants typically use fewer local services. To apply, contact your local council’s tax department and provide proof that you’re the sole adult resident.

- Disability Reduction Scheme: Households with disabled residents may qualify for a reduction under the Disabled Band Reduction Scheme. This reduces your council tax bill to the rate of the band below yours. Eligibility requires that the property is the primary residence of at least one disabled person and has features essential for their needs, such as a room predominantly used by the disabled person, an additional bathroom or kitchen, or sufficient floor space for wheelchair use. Apply by requesting a form from your local council and providing the necessary medical evidence.

- Exempt Properties (Up to 100% Off): Certain properties are exempt from council tax. Common exemptions include:

- Student Accommodation: Properties occupied only by full-time students.

- Armed Forces Accommodation: Dwellings owned by the Ministry of Defence.

- Unoccupied Properties: Homes left empty because the resident is in care or hospital.

To apply, submit proof of exemption status to your local council.

- Council Tax Reduction (CTR) Schemes: If you’re on a low income or receiving certain benefits, you might qualify for a Council Tax Reduction, which can significantly lower your bill. Eligibility is based on income level, savings, and personal circumstances. Each council has its own CTR scheme, so that criteria may vary. Apply by completing a CTR application form from your local council and providing financial statements.

- Other Discounts: Additional discounts include the Carers Discount (for those caring for someone in the household for at least 35 hours a week) and the Severe Mental Impairment Discount (for individuals diagnosed with conditions like Alzheimer’s disease who live alone).

Ensuring You’re Paying the Right Amount

Understanding how discounts interact with your council tax band is crucial for effective financial management. Here are steps to ensure you’re not overpaying:

- Review Your Circumstances: Assess your household composition, income, and disabilities. Changes like someone moving in or out can affect your eligibility for specific discounts.

- Check Your Council Tax Band: Use official government websites to confirm your property’s band. If you believe your property is mis-banded, consider appealing to lower your baseline tax before discounts potentially.

- Apply for Eligible Discounts: Contact your local council to inquire about discounts and exemptions. Provide documentation promptly to ensure the discounts are applied to your bill.

- Stay Informed: Regularly review your council tax bill and stay updated on potential savings, as council policies and national regulations can change. Some councils offer additional discounts or have specific criteria, so always check local guidelines.

Tip: Even small discounts can add up over time, leading to significant savings. Don’t overlook the potential reductions you may be entitled to based on your circumstances and council tax band.

You can effectively lower your council tax bill by understanding and applying for the various reductions and discounts. Remember, it’s not just about the band your property is in but also how your circumstances interact with council tax regulations. Exploring these options can result in substantial savings and ensure you’re not paying more than necessary.

Read More: Council Tax Exemptions & Discounts: Are You Missing Out?

Impact of Home Improvements on Your Council Tax Band

Improvements to your home can enhance your living space and increase your property’s market value. However, it’s essential to understand how these changes might affect your council tax band. Contrary to common belief, not all home improvements will immediately lead to a higher council tax bill. Reassessments of your property’s band typically occur under specific circumstances, and knowing when and how this happens can help you plan your renovations wisely.

How Home Improvements Can Affect Your Council Tax

When you make significant changes to your property, such as building an extension or converting a loft, these alterations can increase the property’s value. However, the Valuation Office Agency (VOA) usually only reassess your council tax band after some time. In most cases, a revaluation of your property for council tax purposes happens when the property is sold to a new owner. This means that while you continue to live in your home after making improvements, your council tax band generally remains the same.

It’s essential to note that certain types of property changes are more likely to trigger a reassessment. Major structural additions like substantial extensions, adding extra floors, or converting a garage into a living space can contribute to an increase in your property’s value and may lead to a higher council tax band upon reassessment. On the other hand, minor renovations such as redecorating, installing a new kitchen or bathroom, or landscaping the garden are less likely to impact your council tax band.

Understanding Revaluation Triggers

Reassessments of your council tax band typically occur under specific circumstances:

- Sale of the Property: The most common trigger for a revaluation is the sale of your property. When ownership changes, the VOA may reassess the property’s band, considering any significant improvements made by the previous owner.

- Splitting or Merging Properties: If you divide one property into multiple units or merge two or more properties into one, a revaluation will be necessary to assign appropriate council tax bands to the new configuration.

- Significant Changes in the Local Area: Occasionally, substantial changes in the surrounding area, such as new developments or infrastructure projects, might prompt a reassessment of property values and council tax bands.

Implications for Homeowners

Understanding how home improvements affect your council tax band is crucial for financial planning. While enhancing your property can increase its market value, it may also lead to higher council tax payments, particularly if you decide to sell your home. It’s advisable to consider the potential long-term costs when planning significant renovations.

For homeowners who plan to stay in their property for an extended period, the immediate impact on council tax may be minimal, as reassessment often only occurs once the property is sold. However, being aware of the potential for increased council tax down the line can help you make more informed decisions about the scale and scope of your home improvements.

Tips for Managing Potential Council Tax Changes

- Plan-Ahead: Before undertaking significant renovations, consider consulting with a property valuation expert or contacting the VOA for guidance on how your planned improvements might affect your council tax band.

- Keep Detailed Records: Document any improvements you make to your property thoroughly. This information can be valuable if there is a dispute or you must provide evidence during a reassessment.

- Consider the Timing: If you plan to sell your property after making significant improvements, be prepared for a higher council tax band for the new owners, which could affect the property’s attractiveness to potential buyers.

- Understand Exceptions: Certain adaptations made for disabled persons may qualify for council tax reductions rather than increases. If you’re modifying your home for accessibility, you might be eligible for a discount under the Disability Reduction Scheme.

Stay Informed About Property Changes and Council Tax

Being proactive and informed about how home improvements can influence your council tax band will help you avoid unexpected costs. It’s essential to balance the benefits of enhancing your living space with the potential financial implications of council tax. By understanding the reassessment process and planning accordingly, you can make home improvement decisions that align with your lifestyle and budget.

Annual Adjustments—Understanding Changes to Council Tax Rates

While your property’s valuation band is a significant factor in determining your council tax bill, it’s essential to recognise that council tax rates are not fixed. Each year, local authorities reassess and adjust these rates to meet the evolving needs of their communities. Understanding how and why these annual adjustments occur can help you anticipate changes in your bill and better manage your household finances.

How Local Authorities Determine Council Tax Rates Annually

Every local council is responsible for providing essential services such as education, waste collection, social care, public safety, and infrastructure maintenance. To fund these services, councils develop a budget from April to March each financial year. The process involves careful consideration of various factors:

- Inflation and Rising Costs: As the cost of goods and services increases due to inflation, councils need to allocate more funds to maintain the same level of service.

- Population Changes: An increase in the local population can lead to higher demand for services like schools, healthcare, and public transportation. Conversely, a declining population might reduce revenue from council tax, necessitating rate adjustments to cover fixed costs.

- Central Government Funding: Councils receive grants and funding from the central government, but the amount can vary yearly based on national budget decisions. Reducing government funding may compel councils to increase council tax rates to fill the gap.

- Local Priorities and Projects: New initiatives to improve the community, such as building affordable housing or investing in green infrastructure, require funding that may be sourced through adjustments in council tax rates.

After evaluating these factors, the council determines the total revenue needed from council tax and sets the rates for each property band.

Understanding the Impact of Annual Rate Adjustments

Even if your property’s band remains unchanged, increasing the council tax rate means you’ll pay more in the upcoming year. For example, if your local authority raises the council tax rate by 3%, your annual bill will reflect this increase. It’s essential to be aware of these adjustments for several reasons:

- Financial Planning: Knowing potential rate changes allows you to adjust your household budget to accommodate a higher or lower council tax bill.

- Awareness of Community Investment: An increase in council tax often signals additional investment in local services and infrastructure, which can enhance the quality of life in your area.

- Engagement with Local Governance: Understanding how your council tax is used can encourage you to participate more actively in local decision-making processes, such as public consultations or council meetings.

Staying Informed About Council Tax Rate Changes

To avoid surprises when your new council tax bill arrives, it’s advisable to stay informed about any rate adjustments made by your local authority. Here are some steps you can take:

Regularly Check Your Local Council’s Website

Most councils provide updates on council tax rates and budget decisions on their official websites. You can typically find this information under sections like “Council Tax,” “Finance,” or “Budget.” Visiting the website periodically, especially at the start of the new financial year, can keep you updated.

Review Annual Statements and Communications

Your council will send annual council tax bills, usually in March or April, detailing the amount due for the coming year. This bill will include information about rate changes and how your payment contributes to various services. Take the time to read through this document carefully.

Attend Public Meetings or Consultations

Local councils often hold public meetings to discuss budget proposals and council tax rates. Attending these meetings can provide insights into why adjustments are being made and allow you to voice your opinions or concerns.

Subscribe to Newsletters or Alerts

Many councils offer email newsletters or text alerts that update essential matters, including changes to council tax rates. Subscribing to these services ensures you receive timely information directly.

Proactive Steps to Manage Council Tax Changes

Being proactive about council tax adjustments can help you mitigate the impact on your finances:

- Adjust Your Budget Accordingly: If you become aware of an impending increase, you can set aside a bit more each month to cover the higher payments.

- Explore Eligibility for Discounts or Exemptions: If the increased rate strains your finances, revisit the discounts and exemptions available, such as the Single Person Discount or Council Tax Reduction schemes for low-income households.

- Engage with Your Council: If you are concerned about the additional revenue being used, consider contacting your local councillor or participating in community forums to express your views.

Tip: Mark your calendar to check for council tax updates at the beginning of each year. Staying informed empowers you to make necessary adjustments and avoid unexpected financial burdens.

Understanding the Broader Context

It’s essential to recognise that while an increase in council tax rates means a higher bill for you, it also reflects efforts by your local authority to maintain or improve community services. Balancing the cost with the benefits received can offer a more comprehensive perspective on these adjustments.

By staying informed and engaged, you can better understand how your contributions are utilised and have a say in local decisions that affect your daily life.

Understanding how to calculate your council tax empowers you to take control of this significant household expense. By delving into the factors that influence your council tax bill—such as your property’s valuation band, local authority rates, and potential discounts or exemptions—you ensure you’re not overpaying and make the most of any opportunities to save.

Knowing your council tax band is crucial because it is the foundation for calculating your bill. Understanding how property changes and annual rate adjustments impact your bill helps you anticipate and manage future expenses.

Now that you’re equipped with this knowledge, it’s time to act:

- Check Your Council Tax Band: Verify your property’s band using official government websites to ensure accuracy.

- Review Your Bill Carefully: Examine your council tax bill to understand how charges are applied and identify any discrepancies.

- Explore Potential Discounts: Investigate whether you’re eligible for discounts or exemptions, such as the Single Person Discount or Council Tax Reduction schemes.

For detailed guidance on checking your council tax band and steps to potentially reduce your payments, read our comprehensive guide: How to Check Your UK Council Tax Band and Reduce Your Bill.

Share your experiences

We’d love to hear from you! Share your experiences in the comments section below:

- Have you found any surprises in your council tax calculations?

- Have you successfully appealed your council tax band or discovered a discount you weren’t aware of?

Your insights could help others navigate their council tax journey more effectively.

Add Comment