Are you ready to take control of your finances in 2025? Whether you aim to crush debt, save for a significant milestone, or learn how to manage your money better, the right tools make all the difference. And what better tool than a book packed with expert advice, proven strategies, and actionable steps to help you budget smarter and build the financial future you deserve? In this guide, you’ll discover the best budgeting books for 2025, handpicked by us to fit every financial situation.

This list has something for everyone, from beginner-friendly guides to deep dives into advanced financial planning. You don’t have to spend hours searching for the perfect resource—we’ve done the work for you, bringing together the most powerful and insightful books to help you succeed with your money goals.

This isn’t just another list; it’s your roadmap to financial freedom. Dive into this carefully curated selection and find the budgeting book to inspire, motivate, and guide you in creating a successful financial plan. Your journey to smarter spending and confident saving starts here. Ready to begin? Let’s explore the best budgeting books for 2025!

Personal Budgeting Books

“The Total Money Makeover” by Dave Ramsey

If you’re serious about taking control of your finances, “The Total Money Makeover” by Dave Ramsey is a must-read. This New York Times bestseller has empowered millions of people to reshape their financial habits, offering a practical, no-nonsense approach to budgeting, debt elimination, and long-term wealth building. Whether you’re starting from scratch or looking to fine-tune your financial game plan, this book delivers results-driven advice that actually works.

What makes “The Total Money Makeover” stand out is its simplicity and focus on proven methods. Dave Ramsey cuts through the noise of get-rich-quick schemes and gimmicks, instead presenting a clear, step-by-step system rooted in real-life success stories. One of the standout strategies in the book is the Debt Snowball Method, which helps readers systematically pay off debts—big and small—while building momentum and confidence. You’ll also learn to recognize the most dangerous financial myths, break bad habits, and adopt new ones that will last a lifetime.

This Classic Edition includes expanded resources and fresh insights, addressing common financial challenges like marriage conflicts over money, tackling college debt, and creating a nest egg for emergencies. With Ramsey’s iconic mantra, “Live like no one else, so later you can LIVE (and GIVE) like no one else!”, this book inspires you to take control, build wealth, and achieve financial freedom. If you’re ready for a financial reset in 2025, “The Total Money Makeover” is the guide you’ve been waiting for.

Read the book now

- Hardcover: £12.89, Amazon.co.uk

- Kindle: £17.99, Amazon.co.uk

“You Need a Budget (YNAB)” by Jesse Mecham

IfBreak free from the paycheck-to-paycheck cycle with Jesse Mecham’s “You Need a Budget (YNAB)”, a Wall Street Journal bestseller that has transformed how thousands manage their money. With its four simple rules, YNAB helps you pay off debt, save for goals, and eliminate financial stress.

YNAB’s rules teach you to:

- Give Every Dollar a Job: Plan your spending intentionally.

- Embrace Your True Expenses: Prepare for irregular costs like holidays or repairs.

- Roll with the Punches: Adjust your budget when life changes.

- Age Your Money: Build a buffer to stop living paycheck to paycheck.

With a conversational tone and actionable advice, Mecham turns budgeting into an empowering tool. If you’re ready to eliminate money worries and take charge of your finances, YNAB is your ultimate guide.

Read the book now

- Paperback: £16.91, Amazon.co.uk

- Kindle: £10.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“The Barefoot Investor” by Scott Pape”

Discover the #1 Australian Bestseller That’s Changed Lives: “The Barefoot Investor”

Looking for the ultimate money guide that’s simple, actionable, and proven to work? “The Barefoot Investor” Classic Edition has been updated for 2022 and beyond, offering timeless financial strategies that fit into your life—no matter where you’re starting from.

This isn’t just another finance book; it’s a life-changing roadmap. With just 10 minutes a week, you’ll learn how to:

- Save a six-figure house deposit in under two years.

- Slash years off your mortgage and save tens of thousands.

- Build a rock-solid retirement plan without needing a million dollars.

- Hand your kids or grandkids a $140,000 start in life.

This is the only money guide you’ll ever need, packed with real stories from everyday people who’ve used the Barefoot Steps to escape debt and achieve financial freedom. Ready to take control of your finances? Start your Barefoot journey today!

Read the book now!

- Paperback: £12.99, Amazon.co.uk

- Kindle: £12.34, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“Your Money or Your Life” by Vicki Robin and Joe Dominguez

In a time of economic uncertainty, “Your Money or Your Life” by Vicki Robin offers a timeless guide to redefining personal finance and finding balance between money and meaning. This updated edition equips readers with actionable steps to get out of debt, build savings, and live well with less.

You’ll learn how to:

- Align your spending with your values.

- Resolve conflicts between lifestyle and priorities.

- Save the planet while saving money.

More than just a financial guide, this book teaches you how to turn your money into a tool for living a fulfilling life. Packed with relevant examples and modern insights, “Your Money or Your Life” is essential reading for anyone ready to take control of their finances and start thriving.

Read the book now!

- Paperback: £13.45, Amazon.co.uk

- Kindle: £9.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“I Will Teach You to Be Rich” by Ramit Sethi

Master Your Money with “I Will Teach You To Be Rich”

Discover the international bestseller that’s transformed millions of lives. Featured on Netflix and now in its completely revised second edition, “I Will Teach You To Be Rich” by Ramit Sethi is your no-nonsense guide to financial success.

This groundbreaking book offers a guilt-free, step-by-step 6-week program to:

- Crush debt and student loans.

- Maximize your savings and investments.

- Negotiate raises and eliminate hidden fees.

- Build a life of financial freedom with simple, proven strategies.

Described by Forbes as a “wealth wizard,” Ramit Sethi combines practical advice with modern money psychology, empowering readers to take control of their finances and live the rich life they deserve. Whether you’re starting from scratch or ready to take your finances to the next level, this book is your ultimate guide to wealth.

Read the book now!

- Paperback: £12.27, Amazon.co.uk

- Kindle: £9.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“Smart Women Finish Rich” by David Bach

Take Charge of Your Financial Future with Smart Women Finish Rich

Empower yourself with the timeless financial wisdom of David Bach’s Smart Women Finish Rich, now updated and revised for a new generation. With over 100,000 copies sold worldwide, this bestselling guide has helped women of all ages and income levels create lasting wealth and financial independence.

Through Bach’s proven nine-step program, you’ll learn how to:

- Spend smarter and align your money with your values.

- Build financial security, no matter your starting point.

- Teach your children about money and leave a lasting legacy.

- Leverage updated strategies for long-term investments and wealth growth.

Packed with practical tools, online resources, and fresh insights, Smart Women Finish Rich gives you the confidence and strategies you need to secure your financial future. Whether you’re just starting or looking to refine your approach, this book is your roadmap to lasting wealth and fulfilment.

Read the book now!

- Paperback: £13.19, Amazon.co.uk

- Kindle: £8.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“The Budgeting Habit” by S.J. Scott

Struggling with debt or feeling overwhelmed by your finances? The Budgeting Habit: How to Make a Budget and Stick to It! offers a simple, step-by-step approach to mastering your money and achieving financial freedom—without sacrificing fun or flexibility.

Inside, you’ll learn:

- How to create a budget tailored to your lifestyle.

- Five proven budgeting methods to find your perfect fit.

- Strategies to stay motivated and turn goals into daily habits.

- Tips to pay off debt faster and save for your future.

This book transforms budgeting into an empowerment tool, showing you how to align your spending with your dreams. If you’re ready to ditch financial stress and start building a better future, The Budgeting Habit is your ultimate guide.

Read the book now!

- Paperback: £8.99, Amazon.co.uk

- Kindle: £1.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

Budgeting Books for Families

“The Family Budget Workbook” by Larry Burkett

Regain Control of Your Finances with The Family Budget Workbook

Struggling to keep track of your family’s finances? The Family Budget Workbook by Larry Burkett is the practical guide you need to take control of your money and build a stable financial future. Designed for families of all sizes, this workbook provides step-by-step guidance and easy-to-follow worksheets to help you create and maintain a realistic budget.

With this book, you’ll:

- Track your spending and identify where your money goes.

- Avoid bounced checks, credit overload, and depleted savings.

- Address common budgeting challenges with practical solutions.

The best part? The included worksheets are reusable year after year, making this a long-term tool for financial success. Say goodbye to end-of-month stress and hello to financial clarity with The Family Budget Workbook—a proven, no-nonsense approach to mastering your personal budget.

Read the book now!

- Paperback: £6.71, Amazon.co.uk

- Kindle: £6.99, Amazon.co.uk

“Smart Money, Smart Kids” by Dave Ramsey and Rachel Cruze

Raise Money-Smart Kids with Smart Money Smart Kids

In a world full of financial pitfalls, Dave Ramsey and Rachel Cruze team up to help parents equip their children with essential money skills in Smart Money Smart Kids. This practical guide offers a step-by-step approach to teaching kids how to handle money wisely, from basic concepts to life-changing habits.

With this book, you’ll learn how to:

- Teach your kids the value of hard work, saving, spending, and giving.

- Help them avoid debt and graduate college debt-free.

- Combat financial discontentment with gratitude and smart money choices.

Dave and Rachel’s no-nonsense, common-sense advice empowers parents to change their family tree by raising a generation that understands how to win with money. Whether your kids are toddlers or teenagers, Smart Money Smart Kids will help you give them the tools to build a secure financial future.

Read the book now!

- Hardback: £21.78, Amazon.co.uk

- Paperback: £29.39, Amazon.co.uk

- Kindle: £7.24, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“Living Well, Spending Less” by Ruth Soukup

Simplify Your Life and Budget with Living Well, Spending Less

Feeling overwhelmed by chaos in your life and finances? Ruth Soukup’s Living Well, Spending Less offers 12 practical secrets to help you regain control, reduce stress, and live the life you’ve always wanted.

This inspiring guide will teach you how to:

- Organize your time, home, and budget.

- Cut expenses without sacrificing joy.

- Find your “sweet spot” where talents and dreams align.

This book is packed with relatable stories and actionable tips, perfect for anyone longing for balance and simplicity. Transform your life one step at a time with Living Well, Spending Less!

Read the book now!

- Paperback: £7.88, Amazon.co.uk

- Kindle: £7.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

- MP3 CD: £96.95, Amazon.co.uk

“Financial Peace Junior” (Family-friendly budgeting tools for children)

Help Your Kids Build Strong Money Skills with Financial Peace Junior

Set your kids up for financial success with Dave Ramsey’s Financial Peace Junior, a fun and practical guide for children ages 3 to 12. This book simplifies essential money concepts and teaches kids how to handle money responsibly from a young age.

Through engaging lessons, kids will learn:

- How to earn, save, spend, and give wisely.

- The importance of hard work and making smart choices.

- Foundational skills to avoid costly financial mistakes later in life.

With Financial Peace Junior, you can instil lifelong money habits that empower your children to win with money and build a bright financial future.

Read the book now!

- Paperback: £42.37, Amazon.co.uk

Business Budgeting Books

“Profit First” by Mike Michalowicz (Business-focused budgeting)

Transform Your Business Finances with Profit First

Tired of your business barely scraping by? Mike Michalowicz’s Profit First offers a game-changing cash management system that flips traditional accounting on its head. Instead of treating profit as an afterthought, this revolutionary approach ensures your business thrives by putting profit first.

With the Profit First system, you’ll:

- Follow 4 simple principles to simplify accounting and prioritize profitability.

- Turn your business into a profit-generating machine instead of a cash-draining monster.

- Learn how small, profitable businesses often outperform large, struggling ones.

Packed with case studies, actionable steps, and Michalowicz’s signature humour, this book is the ultimate guide for entrepreneurs ready to achieve sustained growth and the financial success they’ve always dreamed of. Take control of your business’s future with Profit First!

Read the book now!

- Hardback: £17.75, Amazon.co.uk

- Kindle: £10.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“The One-Page Financial Plan” by Carl Richards

Simplify Your Finances with The One-Page Financial Plan

Financial planning doesn’t have to be overwhelming. Carl Richards, a renowned financial advisor and New York Times columnist, breaks it down in The One-Page Financial Plan—a simple, effective guide to managing your money and achieving your life goals.

This book helps you:

- Identify what truly matters to you and align your finances with your values.

- Create a clear, actionable plan that fits on a single page—no jargon or complexity.

- Make confident financial decisions, no matter the market conditions.

Praised for its approachable and insightful advice, this book transforms financial planning into a meaningful and stress-free process. If you’re ready to take control of your finances and live the life you want, The One-Page Financial Plan is the perfect starting point!

Read the book now!

- Hardback: £12.66, Amazon.co.uk

- Paperback: £14.45, Amazon.co.uk

- Kindle: £8.99, Amazon.co.uk

Debt and Savings-Focused Budgeting Books

“The Debt-Free Blueprint”

Achieve Financial Freedom with The Debt-Free Blueprint

Ready to take control of your finances and build lasting wealth? Jules Hawthorne’s The Debt-Free Blueprint: Strategies to Build Wealth is your ultimate guide to eliminating debt and creating a prosperous financial future.

Inside this comprehensive book, you’ll learn:

- Step-by-step strategies to pay off debt and grow your wealth.

- How to create a budget, maximize income, and minimize expenses.

- Advanced tips for investing, retirement planning, and financial independence.

This book, packed with practical advice, real-life success stories, and actionable steps tailored to your life stage, equips you with the tools to transform your financial journey. Whether you’re just starting out or looking to refine your plan, The Debt-Free Blueprint is the roadmap to a brighter, debt-free future.

Read the book now!

- Paperback: £14.99, Amazon.co.uk

- Kindle: £6.39, Amazon.co.uk

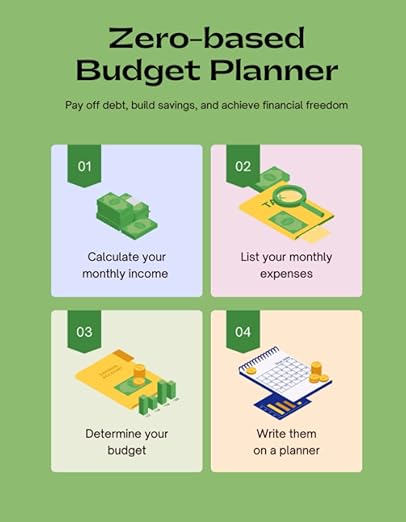

“Zero-Based Budgeting for Debt Freedom”

Master Your Finances with the Zero-Based Budget Planner

Take control of your money and achieve your financial goals with Pablo A. Aguilar’s Zero-Based Budget Planner. This practical guide introduces the zero-based budgeting method, where every expense is planned and justified, helping you start fresh each month with a clear financial strategy.

With this planner, you’ll learn how to:

- Pay off debt faster by assigning every dollar a purpose.

- Build savings and prepare for emergencies.

- Create a clear path to financial independence with intentional spending.

Whether you’re just starting your budgeting journey or looking for a fresh approach, the Zero-Based Budget Planner provides the structure and tools you need to succeed. Start budgeting smarter today!

Read the book now!

- Paperback: £9.61, Amazon.co.uk

“30-Day Budgeting Challenge Workbook”

Struggling to manage your money? Unsure how to save or break free from paycheck-to-paycheck living? The Budget Dynamo 30-Day Budgeting Challenge Workbook is the tool you’ve been waiting for!

This FREE workbook is packed with everything you need to take control of your finances in just 30 days:

- Daily tips to help you stay on track.

- Simple savings trackers and budget planners.

- Practical exercises to break bad habits and build better ones.

- A step-by-step guide to help you achieve your financial goals.

Get your eBook now!

“The Retirement Handbook”

Embrace the Joy of Retirement with The Retirement Handbook

Retirement isn’t the end—it’s the beginning of a new, exciting chapter in your life. Ted Heybridge’s The Retirement Handbook is the ultimate guide to maximising your newfound freedom. Packed with practical advice and inspiration, this book helps you navigate retirement with purpose and joy.

Inside, you’ll discover:

- Ideas for fulfilling hobbies, travel, and new adventures.

- Tips for maintaining your health, staying active, and keeping mentally sharp.

- Strategies to manage your money and ensure financial security.

Whether you’re looking for relaxation, personal growth, or new opportunities, The Retirement Handbook is your trusted companion for this exciting phase of life. Start your journey to a vibrant and fulfilling retirement today!

Read the book now!

- Hardback: £9.19, Amazon.co.uk

- Kindle: £4.99, Amazon.co.uk

Budgeting Books for Kids and Teens

“Money Ninja” (A children’s guide to saving and budgeting)

Empower Kids with Money-Smart Skills Through Money Ninja

Teach your children the foundations of saving, investing, and giving with Money Ninja, part of Mary Nhin’s beloved Ninja Life Hacks series. This fun and engaging book makes financial literacy accessible to kids aged 4 to 10 through relatable characters and witty storytelling.

Why parents and teachers love Money Ninja:

- Introduces essential money skills in a fun and easy-to-understand way.

- Promotes delayed gratification and smart financial habits.

- Perfect for young readers, primary school students, or even toddlers.

Whether you’re a parent, teacher, or counselor, Money Ninja is an excellent resource to help kids build lifelong money-savvy skills—all while having fun!

Get the book now!

- Hardback: £17.99, Amazon.co.uk

- Paperback: £10.07, Amazon.co.uk

- Kindle: £4.46, Amazon.co.uk

“The Ultimate Money Skills Handbook for Teens”

Equip Teens with Essential Money Skills for Lifetime Success

Ready to set your teen on the path to financial independence? The Ultimate Money Skills Handbook for Teens by C.K. Roy is the all-in-one guide that empowers young minds to master earning, saving, investing, and budgeting—giving them a head start on building wealth and lifelong financial success.

What’s inside this must-read handbook?

- The Financial Independence Ladder: A step-by-step framework that simplifies financial literacy into 9 practical steps.

- Actionable Skills: Learn how to earn money, set goals, budget smartly, and avoid debt.

- Interactive Activities: Fun exercises at the end of each chapter to practice and master essential money skills.

Whether they’re preparing for their first job or dreaming big about their financial future, this book offers teens the tools to thrive and succeed. Give your teen the ultimate advantage—start their journey to financial freedom today with The Ultimate Money Skills Handbook for Teens!

Read the book now!

- Hardback: £21.99, Amazon.co.uk

- Paperback: £11.99, Amazon.co.uk

- Kindle: £3.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“Kids Allowance Ledger: A Money Log Book For Kids”

Teach Your Kids Money Skills with the Kids Allowance Ledger

Looking for a fun and practical way to help your child understand money? The Kids Allowance Ledger is the perfect tool to teach kids the value of budgeting, saving, and spending wisely.

With this interactive workbook, kids can:

- Log how they earn and spend their allowance money.

- Reflect on their spending choices with dedicated gratitude prompts.

- Build essential money management and math skills in a fun, engaging way.

Designed to make financial literacy approachable and meaningful, the Kids Allowance Ledger empowers children to develop smart money habits they’ll carry into adulthood. Start teaching your kids the value of budgeting today!

Read the book now!

- Paperback: £7.00, Amazon.co.uk

Inspirational or Narrative Budgeting Books

“Broke Millennial” by Erin Lowry

Level Up Your Finances with Broke Millennial Takes On Investing

Feeling unsure about how to start investing? Erin Lowry’s Broke Millennial Takes On Investing is the perfect beginner’s guide for anyone who thinks they’re not ready—or rich enough—to dive into the world of investing.

This hands-on book answers the key questions every new investor faces, such as:

- Should you invest while paying off student loans?

- How can you invest responsibly and align with your values?

- Are robo-advisors and investing apps worth it?

- What’s the simplest way to buy and sell your first stock?

From breaking down intimidating financial jargon to offering practical, anxiety-reducing strategies, this guide empowers millennials (and anyone new to investing) to start building wealth confidently begin building wealth. If you’re ready to take charge of your financial future, Broke Millennial Takes On Investing is your go-to resource!

Read the book now!

- Paperback: £11.18, Amazon.co.uk

- Kindle: £2.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“Meet the Frugalwoods” by Elizabeth Willard Thames

Discover the Power of Simple Living with Meet the Frugalwoods

What if you could abandon the stress of chasing material possessions and embrace a life of purpose and financial freedom? In Meet the Frugalwoods, award-winning personal finance blogger Elizabeth Willard Thames shares her inspiring journey of leaving a successful city career to live a simpler, more meaningful life on a rural homestead by age 32.

This deeply personal book reveals:

- How Elizabeth and her husband saved over 70% of their income to achieve financial independence.

- The transformative power of frugality and rejecting the consumer-driven lifestyle.

- Practical insights on how to craft your own path toward a purpose-driven, financially free life.

Whether you dream of early retirement, more time with family, or simply breaking free from the rat race, Meet the Frugalwoods offers a roadmap to building the life you truly want—no matter where you live. Start your journey to financial independence and fulfilment today!

Read the book now!

- Paperback: £13.97, Amazon.co.uk

- Hardback: £18.99, Amazon.co.uk

- Kindle: £12.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“Rich Dad Poor Dad” by Robert Kiyosaki

Marking 25 years as the #1 personal finance book of all time, Robert T. Kiyosaki’s Rich Dad Poor Dad remains as relevant today as when it was first published. With over 40 million copies sold worldwide and translations in 38 languages, this timeless classic continues to empower readers to rethink money and build lasting financial success.

What makes this book a must-read?

- Debunk Financial Myths: Learn why a high income isn’t necessary to become wealthy.

- Understand Assets vs. Liabilities: Gain clarity on how to make your money work for you.

- Prepare the Next Generation: Discover how to teach your kids essential financial lessons that schools often overlook.

Rich Dad Poor Dad shares the transformative story of Kiyosaki’s two father figures—his own “poor dad” and his best friend’s “rich dad.” Through their contrasting lessons, you’ll learn how to break free from traditional financial thinking and take control of your future.

Whether starting your financial journey or looking to level up your investing game, Rich Dad Poor Dad offers timeless wisdom and actionable insights to achieve economic independence. Take the first step toward a brighter financial future today!

Read the book now!

- Paperback: £13.48, Amazon.co.uk

- Kindle: £6.27, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“Atomic Habits” by James Clear

Looking to make meaningful changes in your life? James Clear’s Atomic Habits is the ultimate guide to achieving life-changing results through the power of small, consistent actions. With over 1 million copies sold and rave reviews worldwide, this international bestseller teaches you how to break bad habits, build better ones, and unlock your full potential.

What makes Atomic Habits so impactful?

- Tiny Changes, Big Results: Learn how small, consistent actions create powerful, long-lasting transformations.

- Proven Strategies: Discover the art of Habit Stacking, the Two-Minute Rule, and more practical tools backed by cutting-edge psychology and neuroscience.

- Inspiring Stories: Hear how Olympic athletes, CEOs, and scientists use these principles to stay motivated and productive.

Whether you want to improve your health, career, or relationships, Atomic Habits provides actionable steps to build stick habits. Start your journey toward a better life today with this life-changing guide!

Read the book now!

- Hardback: £20.68, Amazon.co.uk

- Paperback: £10.00, Amazon.co.uk

- Kindle: £6.99, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

“The Psychology of Money” by Morgan Housel

Ever wonder why financial success often depends more on behavior than knowledge? Morgan Housel’s The Psychology of Money offers a fresh perspective on wealth, exploring the emotional and psychological factors that shape how we earn, spend, and save.

With over 6 million copies sold worldwide, this bestselling book delivers timeless lessons through 19 engaging short stories that reveal:

- Why financial decisions are rarely made with logic alone.

- How personal history, ego, and emotions influence money choices.

- Practical insights to help you rethink your relationship with money.

Praised by readers and featured on top podcasts like Diary of a CEO, The Psychology of Money is essential reading for anyone seeking to improve their financial life. Whether you’re managing personal finances or making investment decisions, this book provides the tools to think smarter about money and live happier with it. Transform your financial mindset today!

Read the book now!

- Hardback: £24.66, Amazon.co.uk

- Paperback: £12.29, Amazon.co.uk

- Kindle: £8.44, Amazon.co.uk

- Audiobook: £0.99, Amazon.co.uk

Add Comment