Whether you’re starting a new venture or switching from another bank, Barclays offers a range of corporate bank accounts that cater to businesses of all sizes. This guide will walk you through the process step-by-step, ensuring you have all the information you need to open your Barclays business bank account smoothly. Let’s dive in!

[ez-toc]Why Choose Barclays for Your Corporate Bank Account?

Before we get into the nitty-gritty of opening an account, let’s discuss why Barclays is a solid choice for your business banking needs. Barclays has a long-standing reputation in the UK banking sector, offering reliable services and excellent customer support. They provide various corporate bank accounts with features tailored to different business requirements.

Step 1: Determine the Right Type of Corporate Bank Account

First, you need to figure out which type of business bank account suits your needs. Barclays offers several options, including:

- Business Current Account: Ideal for everyday banking needs.

- Business Savings Account: Great for setting aside funds for future investments.

- Foreign Currency Account: Useful if your business deals with multiple currencies.

- Community Account: Designed for non-profit organizations and charities.

Look at your business’s financial activities and decide which account type aligns best with your requirements.

Helpful Link: Barclays Business Accounts Overview

Step 2: Gather Required Documents

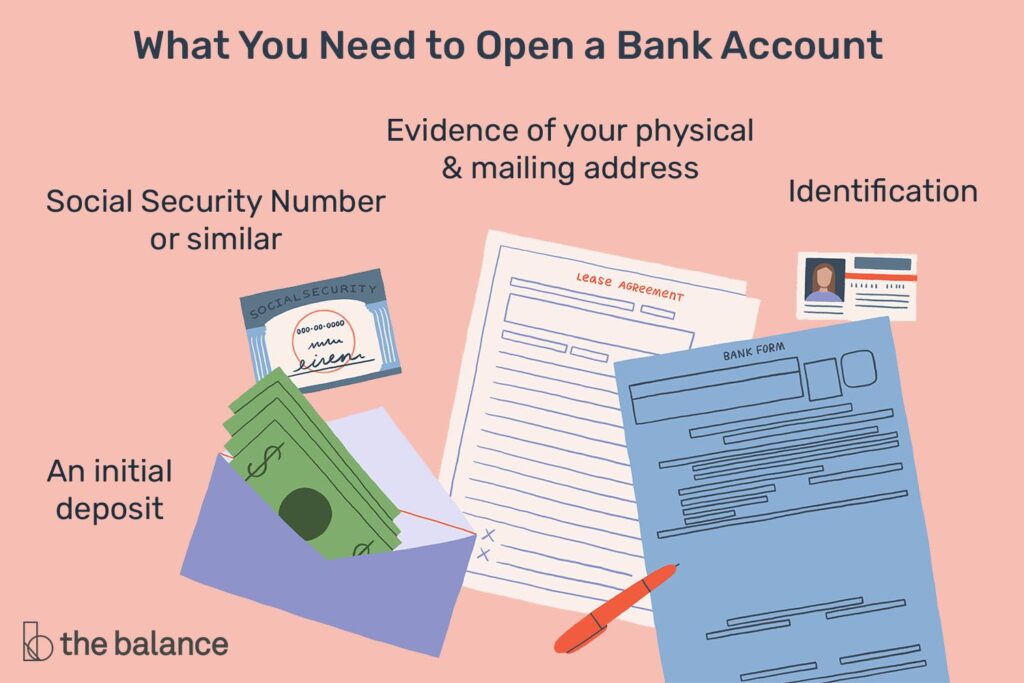

Once you’ve chosen the correct account type, it’s time to gather all the necessary documents. Barclays requires specific documents to verify your business and its directors. Here’s what you’ll need:

- Proof of ID for all named company directors and account signatories (e.g., passport or driving licence).

- Proof of address for all named company directors and account signatories (e.g., utility bill or bank statement).

- Evidence of your business’s trading address.

- Your company’s registration number and Certificate of Incorporation (for limited companies).

- Partnership Agreement (for partnerships).

Ensure all documents are up to date and correctly prepared to avoid delays in the application process.

Step 3: Apply Online or Visit a Branch

Now that you’ve gathered all your documents, you can start your application. Barclays offers the convenience of applying online, ensuring a smooth and hassle-free process. If you prefer face-to-face assistance, you can also visit a local branch.

Applying Online

- Visit the Barclays Website: Go to the Barclays business banking section.

- Fill Out the Application Form: Provide all necessary information about your business and upload the required documents.

- Submit Your Application: Once you’ve completed the form, submit your application for review.

Visiting a Branch

- Find Your Nearest Branch: Use the Barclays branch locator tool.

- Schedule an Appointment: Call or book an appointment with a business advisor online.

- Bring Your Documents: Bring all the necessary documents to your appointment.

Helpful Link: Barclays Branch Locator

Step 4: Initial Consultation and Review

After you’ve submitted your application, Barclays will review your information and documents. This usually takes a few days. If they need any additional information or clarification, a Barclays representative will be in touch, providing you with the support you need.

Step 5: Account Approval and Activation

If your application is successful, Barclays will notify you and provide details on activating your account. You’ll receive your account number, sort code, and debit cards (if applicable) in the mail. Follow the instructions provided to activate your account and set up online banking.

Step 6: Set Up Online and Mobile Banking

Once your account is activated, the next step is to set up online and mobile banking. This will allow you to manage your account, make payments, and check your balance from anywhere.

- Register for Online Banking: Visit the Barclays website and register for online banking using your account details.

- Download the Barclays App: Available on both iOS and Android, the app offers a convenient way to manage your finances on the go.

Step 7: Explore Additional Services

Barclays offers various additional services that can help streamline your business operations. These include:

- Business Loans and Overdrafts: For managing cash flow or financing new projects.

- Merchant Services: For processing customer payments.

- Foreign Exchange Services: For businesses dealing with international transactions.

Helpful Link: Barclays Business Services

Tips for Managing Your Corporate Bank Account

Now that you have your Barclays business bank account, here are some tips to make the most of it:

Keep Your Records Updated

Ensure all your business information, such as address and contact details, is always current. This helps avoid any issues with transactions or communication from the bank.

Monitor Your Account Regularly

Regularly check your account statements and transactions to keep track of your finances and catch any discrepancies early.

Use Available Tools and Resources

Barclays provides various tools and resources to help you manage your business finances. Please make use of their online calculators, financial guides, and webinars.

Helpful Link: Barclays Business Banking Tools

Opening a Barclays business bank account is straightforward when you know what steps to follow. By choosing the correct account, gathering the necessary documents, and following through with the application process, you’ll be set up and ready to manage your business finances effectively.

If you’re ready to open your corporate bank account with Barclays, get started today. For more detailed information and to begin your application, visit the Barclays website.

Add Comment