There’s no shortage of myths and misconceptions about retirement pension planning. Navigating the maze of information can be daunting, especially with so many myths floating around. In this blog post, we will debunk the most common retirement pension myths and provide the facts that UK savers need to know. We’ll cover topics such as the importance of early pension planning, the role of the state pension, the variety of pension plans available, and the benefits of professional advice.

Table of Contents

- Myth 1: "You Don't Need to Start Saving for Your Retirement Pension Until You're Older"

- Myth 2: "The State Retirement Pension Will Be Enough to Live On"

- Myth 3: "All Retirement Pension Plans Are the Same"

- Myth 4: "You Can't Touch Your Retirement Pension Until You Retire"

- Myth 5: "Once You Start Drawing Your Retirement Pension, You Can't Contribute Anymore"

- Myth 6: "Your Retirement Pension Isn't Inherited"

- Myth 7: "You Can Only Have One Retirement Pension"

- Myth 8: "It's Too Late to Start Saving for a Retirement Pension"

- Myth 9: "High-Risk Investments Are Not Suitable for Retirement Pension Funds"

- Myth 10: "You Don't Need Professional Advice for Your Retirement Pension"

Myth 1: “You Don’t Need to Start Saving for Your Retirement Pension Until You’re Older”

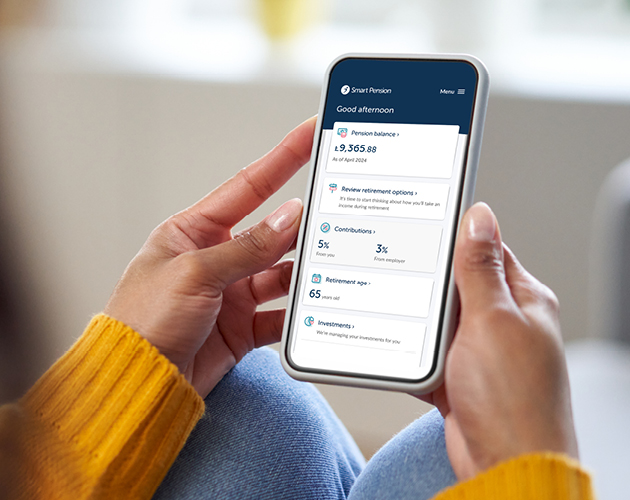

This is one of the most harmful retirement pension myths. Many believe they can start saving for their retirement pension later in life. However, the truth is that the earlier you start saving for your retirement pension, the better. By debunking this myth, we empower you to take control of your future. Compound interest works best over time, meaning your retirement pension pot will grow significantly more if you start early.

Read this detailed guide from the Money Advice Service for more information on the benefits of starting your pension early. It explains why early planning can lead to substantial long-term benefits.

Myth 2: “The State Retirement Pension Will Be Enough to Live On”

Another common myth is that one should rely solely on the state retirement pension. The UK state retirement pension provides a foundation, but it is unlikely to cover all one’s retirement expenses. The full new state retirement pension is around £175.20 per week, which won’t be enough for most to maintain their pre-retirement lifestyle.

Check out this overview on the UK government’s website to understand what you can expect from the state pension and why it might need to be more on its own.

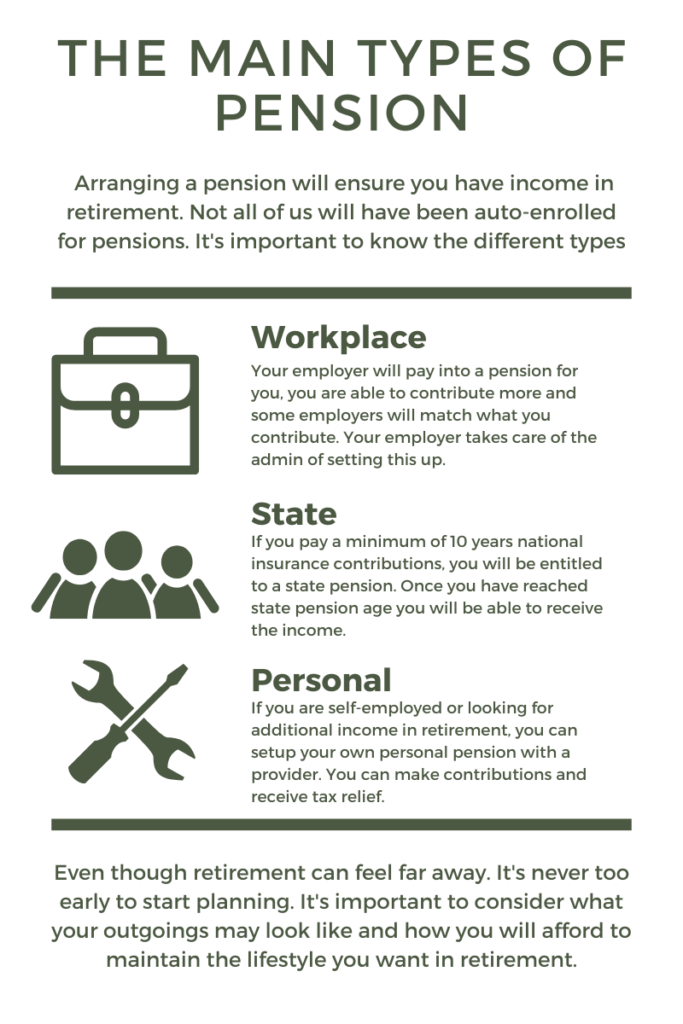

Myth 3: “All Retirement Pension Plans Are the Same”

Not all retirement pension plans are created equal. Workplace pensions, personal pensions, and self-invested personal pensions (SIPPs) all offer different benefits and drawbacks. Understanding the differences is crucial to choosing the plan that best fits your financial situation and retirement goals.

Visit Which. This resource explains each type of pension’s unique features and benefits and compares their workings.

Myth 4: “You Can’t Touch Your Retirement Pension Until You Retire”

While you can only access your retirement pension funds once you reach the age of 55 (rising to 57 in 2028), debunking this myth reveals the flexibility available. For example, with pension freedoms introduced in 2015, you can take up to 25% of your pension pot tax-free from age 55 and have various options for accessing the remaining funds. This flexibility puts you in control of your financial future.

Read this guide from the Pensions Advisory Service to learn more about pension freedoms and how they can benefit you.

Myth 5: “Once You Start Drawing Your Retirement Pension, You Can’t Contribute Anymore”

Contrary to popular belief, you can continue to contribute to your retirement pension even after you start drawing from it. Contributions can still be made, and tax relief is available on contributions up to age 75. This can be a valuable way to continue growing your retirement savings, especially if you have additional income.

For more information on contributing to your pension after retirement, visit the Money Advice Service.

Myth 6: “Your Retirement Pension Isn’t Inherited”

Another widespread myth is that your retirement pension dies with you. However, many pensions can be passed on to your beneficiaries. If you die before age 75, your beneficiaries can usually inherit your pension pot tax-free. After 75, they will have to pay income tax on any withdrawals.

Read this guide on pension inheritance by PensionBee to learn more about how pensions can be inherited and the rules.

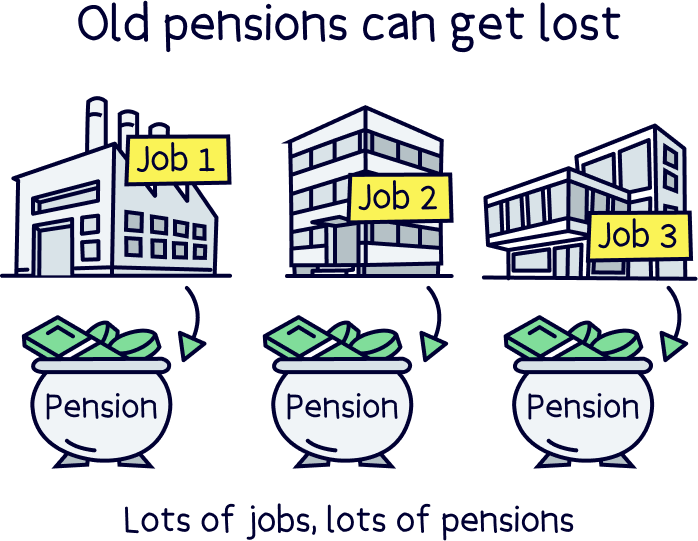

Myth 7: “You Can Only Have One Retirement Pension”

Multiple pensions are common, primarily if you’ve worked for different employers. Keeping track of various pensions can be challenging but consolidating them can make managing your retirement savings more accessible and efficient.

For advice on combining pensions and managing multiple pension pots, check out Pension Wise.

Myth 8: “It’s Too Late to Start Saving for a Retirement Pension”

While saving early is always better, there is always time. Even if you start saving for your retirement pension later in life, you can still make significant contributions and take advantage of employer-matching contributions and tax reliefs.

Please read this guide from Age UK for tips on starting a pension later in life and making the most of it.

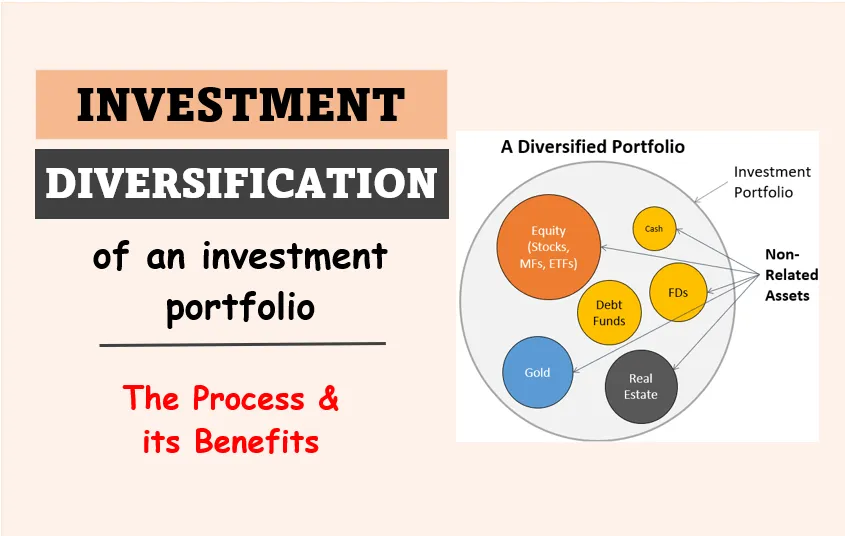

Myth 9: “High-Risk Investments Are Not Suitable for Retirement Pension Funds”

Investing in higher-risk assets can benefit your retirement pension, especially if you start early. These investments can provide higher returns, although they come with greater risk. Diversifying your investment portfolio can help manage this risk while still allowing for growth.

For more information on investment strategies for pensions, read this guide from Fidelity.

Myth 10: “You Don’t Need Professional Advice for Your Retirement Pension”

Navigating retirement pension planning can be complex, and professional advice can be invaluable. By seeking the guidance of financial advisors, you can gain confidence in your decisions and maximise your retirement savings.

To find a qualified financial advisor and understand how they can help, visit the Money Advice Service.

Conclusion

Debunking these retirement pension myths is crucial for UK savers to make informed decisions and secure a comfortable retirement. Remember, the key to a successful retirement pension plan is starting early, staying informed, and seeking professional advice. Keep in mind that pension regulations and rules may change, so it’s essential to stay updated and seek professional advice when necessary.

Add Comment